Do you know your business credit score?

Risk-Free

Check your business credit score without it having a negative impact

Safe and Secure

Our secure platform means all your information is safe

Fast and Free

No cost, no obligation. Get your business credit score immediately

Know Your Score

Your business credit score can provide you with a sense of the financial position of your business. Your credit score is one of the indicators used by banks and lenders in assessing the risk of lending to your business. Typically in Australia, your credit score is negatively impacted each time you check it through a lender or bank. With OnDeck’s ‘Know Your Score’, you can check your business credit score without leaving a footprint. This way, you can establish the health of your business without the risk of lowering your business credit score!

‘Know Your Score’ is absolutely free, secure and immediate. Simply provide your company details and your score will be provided there and then, by Equifax. Once you receive your business credit score, there is no obligation to apply for a loan from OnDeck, or any other financial services provider. OnDeck will apply our own credit assessment which will be different from your free Equifax business credit score.

Building a strong credit profile

Your business credit score is a numeric value between 0-1200, and is derived from your business credit profile. Your credit profile contains additional information about your business’s credit history, so it’s important to build a strong credit profile.

Here are some tips to help you build your credit profile:

Make sure your profile is accurate – the credit bureaus offer dispute resolution processes to remedy any verifiable incorrect information contained in your report.

Establish trade accounts with your suppliers – leverage 30- or 60- day payment terms, but be sure to stick to the agreed upon terms.

Use the credit you need and stay current – avoiding credit altogether can make it hard for lenders to assess your business, financially, but be sure to only use credit as needed.

Keep your personal and business credit separate – mixing the two can have a negative impact on both your personal and business credit reports.

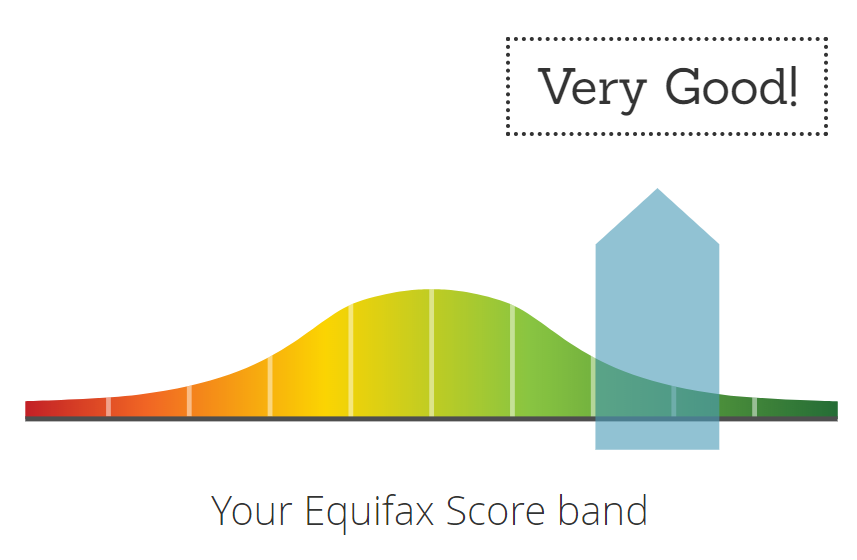

Credit scores are broken into categories, ranging from Poor (0-509) to Excellent (833-1200):

One-Third of business’s that used Know Your Score have an “Excellent” business credit score, with 769 as the average score*.

*This data is based on business credit scores provided by OnDeck Australia to Australian SMEs since Sept 2016. The platform is powered by credit bureau Equifax.

“I looked into OnDeck online and found the whole process very easy and the Know Your Score tool was very straightforward. I'd definitely recommend OnDeck to another business.”

Max MacArthur

New View Window Cleaning

Avalon Beach, Sydney, Australia

Frequently Asked Questions

Credit Bureaus, such as Equifax and illion, collate information about your business, your relationships with suppliers and your payment history, in your credit profile. Your business credit score is pulled by the Credit Bureaus from your credit profile, and is shared with banks and other lenders. OnDeck’s Know Your Score tool is powered by Equifax, Australia’s largest credit reporting agency.

Equifax is a global information solutions company and the leading provider of credit information and analysis in Australia and New Zealand. Equifax powers the financial future of individuals and organisations around the world. Equifax helps its customers make informed financial decisions by using that combined strength of unique trusted data, technology and innovative analytics. Equifax is headquartered in Atlanta, GA. Equifax operates in 24 countries across North America, Central and South America and Europe. More recently, Equifax expanded into the Asia Pacific region, with the acquisition of Veda, a data analytics company and the previous leading provider of credit information and analysis in Australia and New Zealand. Combined, the companies bring nearly 170 years of data insights to the marketplace.

Yes, your business credit score is different from your personal credit score. A business Equifax Score uses commercial indicators. These include registered defaults, potential loan enquiries or any external administrations that may be registered against a business. Alternatively, a personal credit score is a number that represents the information contained in your personal credit report. Many lenders will also look at your personal credit score, along with your business credit score, when assessing whether a business is a good candidate for financing.

All you need is some personal information, and the following basic business information:

- Your ABN

- Time in business

- Revenue

As soon as you complete the form and click “submit”, your business credit score will be generated and will appear on the next page.

The Equifax business credit score is provided to you free of charge. There are no hidden fees or charges.

No, there are no obligations to take a loan or any other product from OnDeck or any other lender.

When you order your business’s credit score, you provide consent to OnDeck to send you marketing material around our business financing options. However, you can opt-out of this communication at any time by emailing customerservice-au@ondeck.com.au.

To access the Equifax Score for your business, you will be asked to agree to the Equifax terms and conditions. For ease of reference, these terms and conditions are cited below:

I agree that Equifax and OnDeck can use and disclose my personal information to contact me about other goods and services offered by the Equifax Group or OnDeck and use that information for direct marketing purposes. I agree to receive communication via email, SMS or other electronic communication, or by phone or mail.

Your personal information may be used by Equifax in accordance with these terms and conditions. If you wish to opt-out from receiving marketing material from Equifax, please find the details here: https://www.equifax.com.au/about-us/privacy-policy-australia.

OnDeck will apply our own credit assessment which will be different from your free Equifax business credit score. OnDeck uses personal and business credit scores from more than one credit reporting bureau and its own proprietary credit assessment and scoring system in assessing loan applications. A good score from the Equifax free business credit score is for your information in deciding whether to apply for a loan. Though, keep in mind, whether or not you’re offered a loan is subject to you completing an application. You can find out how to apply for an OnDeck loan here.

The Know Your Score tool is available to companies with an ASIC registered business name.

There are a couple of reasons why your business may not receive a business credit score:

- Your business isn’t registered with ASIC – scores can only be provided for Companies or Sole Traders and Partnerships that have a registered business name.

- The business and/or all of the directors/proprietors are not currently credit active or have not been credit active. (Credit active is where a person or organisation has had a credit enquiry recorded on the Equifax Bureau within the past 5 years.)

- There is a petition to wind up or the business is under External Administration.

- At least one of the directors and/or proprietors has been insolvent in the last 7 years.

While this information is useful, it is worth investigating further why your business doesn’t have a credit score. When you use the Know Your Score tool, you’ll be given more information on what to do next.